And It May Help Explain Why It Feels Worse Than “Normal” This Time

By Dan LaMacchia - 7/6/2022

A respected money manager of mine is Confluence Investment Management in St. Louis because their original team is primarily the research department of a regional firm where I worked decades ago. I’ve always liked their name choice – Confluence – because it surely well describes how they and I view the mass of news and economic data affecting today’s market action. Sanity only comes from the never-ending process of filtering out what’s noise and what’s really meaty and important to the investment markets.

Today’s confluence of events – and I’m really defining it as those “since the first of the year when it seemed that everything blew apart” – are economic, political, geo-political, social, economic, and on-the-street impacts on households (inflation felt at home). All of these have some impact on the psyche of the investment markets, although some more-so than others, and none of these are uncommon, unusual, or rare. Something else is in the confluence now that hasn’t been for more than 20 years: An “activist” Federal Reserve (Fed) and it’s sibling, the “Bond Vigilantes”.

I’m going to walk you back a bit to explain a policy change that, if borne out as it seems to be indicating, I think will be looked back on as a seminal change in the operation of the economy. This historic trip ENDS with the Fed increasing interest rates .75% last month, representing the largest, single rate increase since the bond market “crash” of 1994 (I was there!). And they’re expected to do it again this summer by raising “interest rates” another .75% taking Fed Funds (overnight lending between banks) to nearly 2.00% from its nearly-0% level in January of this year. Without getting into the weeds about how little the Fed Funds rate actually affects citizens, the psychology of these big increases are one of several tools that the Federal Reserve is currently implementing to both slow down the economy and reduce the size of the assets on its balance sheet.

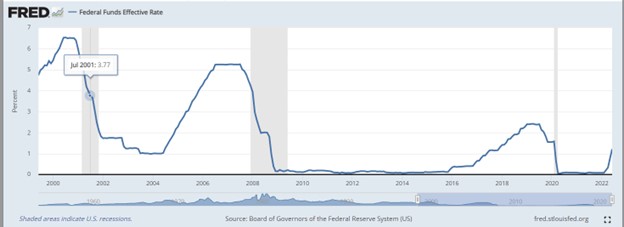

The sea-change reversed Fed policy that began during the dot-com crash of 2000 when the then Fed chair slashed interest rates to prevent the meltdown from becoming contagious. It was the right move at the time but – and here’s the salient point – the Fed continued to stay “loose” and accommodative with low rates for four years then, in 2005, began a tightening cycle that lasted right up to the 2008 financial crash. Then they got REALLY stimulative by slashing rates to almost zero. Ben Bernanke (then Fed chairman) made his famous statement “I will drop dollars from helicopters to prevent the next Great Depression”. Again, it was absolutely the correct move. But what exactly is “accommodative” and, in its daily actions, how does the Fed stimulate (I didn’t see any helicopters hovering over my house!). Here’s a chart of Fed Funds between the Dot-Com crash and today:

The Fed as “Buyer of Last Resort”, aka: “The Fed Put”

Using the chart above as an example proxy of Federal Reserve accommodation, it’s clear that during times of hyper-stress such as the dot-com crash, the housing and global financial meltdown and, most recently, the covid-correction the Fed steps in to stabilize the markets and to use its tools to attain the mandates under which it operates: low unemployment and stable prices. One tool is buying corporate bonds, mortgages, and Treasuries in the open market. When we hear that the Fed’s “…balance sheet has expanded…” to nearly double-digit TRILLIONS of dollars, largely it is soaking up Treasury bonds issued by the Administration to finance its spending. This system of the Fed acting as a “shock absorber” to Treasury spending usually works well but, since at least 2000, the Fed has been extraordinarily accommodating to Treasury spending. Not so much anymore.

Enter Inflation – The Great Brake Pedal

The thing is that, as the graph below shows, inflation since 2000 has not been a major issue, remaining contained to below 1% annual growth for nearly the entire time. Low inflation gives room for the Fed to be stimulative without driving inflation higher. But the stimulus from the Administration during the covid pandemic, as funded by the Treasury issuing record levels of new debt, was different from either the 2000 or 2008 crises. This time, the confluence of attempted covid solutions included the Administration paying businesses to lay off employees, then paying those employees to stay home while willfully ignoring the fact that, without productivity, paying people to do nothing is PURE inflation. The evidence is revealed in the graph…

The Fed’s Job is to Take Away the Punch Bowl…

…just as the party starts getting good.

So, there we were in a roaring party of getting paid to stay home, starting Etsy businesses in our basements, spending, spending, spending, getting checks in the mail… all with little to no commensurate gains in productivity. Then add covid-related supply chain disruptions and an Administration determined to change the nature of energy production in the US, and we have a prescription for hyper-inflation. The inflation party is roaring.

Then

The

Unexpected

Happens

The Fed Grows a Backbone

Recall the Fed’s mandates: high employment and stable prices. The unemployment picture is explainable but, whew!, that inflation! Reports suggest 7%, 8%, or even higher year-over-year increases for many goods, and the Fed is aiming its oversized rate increases on taming that inflation beast. At the same time, they’re extracting liquidity from the economy by selling bonds from its balance sheet. Despite the Treasury wanting to sell more bonds to spend more, the Fed is holding firm and, instead, showing its new determination to end its policy of buyer-of-last-resort. The result to expect is that any new spending from the Administration will be met with higher costs to borrow. This “new” Fed policy is surfacing specifically because of the inflation being driven by government spending and policies that restrict productivity and the movement of supply chain goods.

Stagflation? Or Soft Landing?

The members of the Federal Reserve Board are all a lot smarter than most, including me. I’ve seen policy actions going back to Volker in the early ‘80s, and I’ve also watched pundits and talking heads mistake their own flawed analogies as predictors of Fed failure. I’m not so gifted (or narcissistic); I think the default answer should always be that the Fed will get it right and engineer a soft landing for the economy instead of a slamming jolt to the system. The Fed now seems to be following their important mandates while leaning in against more spending that they can’t absorb. And it’s wagging its proverbial finger at Congress with a caution that the Fed isn’t going to be the last buyer this time.

Like the Cicada Bugs, the Bond Vigilantes Have Emerged from a Long Sleep

If there’s any group that can keep the Fed honest, it’s the bond market (not Congress, as you might have thought). And bond market participants have the institutional power of billions under management to get what they want by “pushing” markets. Sometimes, the Bond Vigilantes (BVs) call BS to the Fed’s actions by countermanding policy actions ahead of the Fed. Former Fed Governor Alan Greenspan coined the phrase “It’s a conundrum” in answering a Senator’s questions about curious bond market actions that seem contrary to Fed policy. It’s not a conundrum, it’s just institutional fear and greed among human bond traders. If the BVs see market pressures resulting from Fed policy, they’ll vote their portfolio and not wait for an explanation. That countermanding, pushing-and-pulling, and holding the Fed’s (and Treasury’s) feet to the fire for purely greed or fear reasons is the demonstration of the market forces the Fed is trying to produce. And, lest you think the Fed is impotent to the market, there are many, many times when the Fed uses the market’s mood and prescience for its own benefit without many investors even knowing it!

The Fed as Independent Watchdog

A strong and politically independent Federal Reserve is the best weapon the US has against ever again experiencing times as dire as the Great Depression. Their intended purpose is to act as a shock absorber to the country’s financial situation but, since about 2000, they’ve only been able to act as a stimulant with more spending because there was a greater risk of deflation than inflation. The circumstances of covid’s economic impact and the resulting pure inflation has, for the first time in as many years, caused the Fed to push back and become restrictive in its monetary policies. In doing so, it’s flexing its policy muscle enough to impact the larger spending and inflation picture to engineer the hoped-for economic soft landing. I think the smart play is to believe they will be successful and, as a result, preserve their independence to oversee the country’s monetary policy.

FRED Graphs - Copyright Federal Reserve Bank of St. Louis. 2022. All Rights Reserved. All FRED graphs appear courtesy of the Federal Bank of St. Louis. http://fred.stlouisfed.org